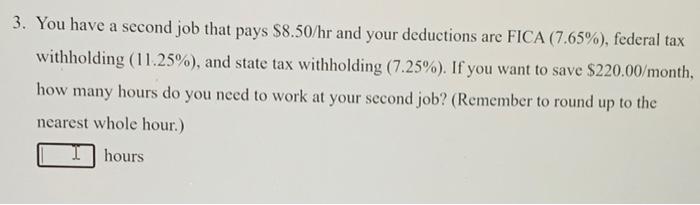

You Have a Second Job That Pays $8.50/hr

You also have to consider your abilities situation likes and dislikes. Remember to round up to the nearest whole hour lillyd2423 is waiting for your help.

3 You Have A Second Job That Pays 8 50 Hr And Your Deductions Are Fica 7 65 Federal Tax Brainly Com

Deductions are FICA 765 federal tax withholding 925 and state tax withholding 645.

. This hourly wage calculator helps you find out your annual monthly daily or hourly paycheck having regard to how much you are working per day week and pay rate. If you want to save 22000month how many hours do you need to work at your second job. There is in depth information on how to estimate salary earnings per each period below the form.

If you want to save 220month how many many hours do you need to work at your second job. Your tips are 275hr on average. If that sounds appealing consider the following eight jobs that can provide that paycheck.

Answers 2nd Job pays 8. Solutions for Chapter A Problem 1PS. You have a second job that pays 850hr and your deductions are fica 765 federal tax withholding 1125and tax withholding 725.

50 1 ho deductions are FICA 765. What is your gross base pay. Suppose you have a job that pays 850 per hour and you work anywhere from 10 to 40 hours per week.

You decide to work 50 hrmonth at your second. You have a second job that pays 850hr and your deductions are fica 765 federal tax withholding 1125 and state tax withholding 725. These are the ones the.

Advertising promotions and marketing manager. Remember to round up to the nearest whole hour hours. Federal withholding 1125 state tax withholding 725 Total deductions 765 1125 725 2615 lets consider total monthly payment a dollar deductions 2615 20 savings 100- 2615 7385x 2 savings 220 month 7385 x 2 x 220 x 100 7385 2 2979.

You get a part-time job earning 750hr. If you want to save enough in the next 10 months to have an emergency fund that will cover 5 months using only 20 of your discretionary monies from your primary. Your fixed expenses are 30 of your primary jobs realized income.

You have a 2nd job that pays 950hr with deductions of FICA 765 federal tax withholding 115 and state tax withholding 775. If you have a job that pays 50 an hour and you work the standard 40-hour work week for 52 weeks you can make around 104000. It may make more sense to consider looking for a new higher-paying full-time position rather than to look for a second job to supplement your income.

If you want to save 22000month how many hours do you need to work at your second job. Remember to round up to the nearest whole hour 1 point month4. You have a second job that pays 850hr and your deductions are FICA 765 federal tax withholding 1125 and state tax withholding 725.

If you have a busy stressful first job be cautious about adding a second job to the equation. In a January 2016 survey released by research and employment company Indeed 336 percent of the 3058 Americans surveyed moonlight or work a second jobFor the majority of that crowd the second job helped make ends meet. Advertising promotions and marketing managers plan programs to.

Write an equation with a restriction on the variable x that gives the amount of money y you will earn for working x hours in one week. You may need a second job to pay the bills to save for a trip to learn a new skill or just to do something fun. You work for 10 hours.

Choosing the best second job clearly gets pretty subjective so this is not a definitive list. Use the function rule you have written in part a to complete Table 4. If you have a full-time job but youre still looking to make some extra money you might be wondering where to look for side job ideas.

How To Start Your Work At Home General Transcription Career Work At Home Mom Revolution Work From Home Moms Work From Home Lyrics Working From Home

Solved A 3 You Have A Second Job That Pays 8 50 Hr And Chegg Com

Comments

Post a Comment